Many forex traders rely on Exness because of its strong reputation, fast withdrawals, and user-friendly environment. However, exploring additional trading platforms can offer valuable advantages that broaden a trader’s skill set and improve long-term growth. No single broker or platform can meet every trading need, and diversifying where you trade can help you discover new tools, better pricing, and features that align more closely with your trading style.

Different brokers offer unique spreads, execution speeds, and trading conditions. By trying alternatives, traders may find platforms that provide lower trading costs, advanced charting tools, or more stable order execution during high-volatility events. This can directly impact profitability and risk management. Some brokers also offer specialized features such as deeper market analysis, built-in trading communities, or automated strategy tools that are not available on Exness.

Exploring other platforms also reduces dependency on a single broker. Relying on one platform means all your trading activities—and potential risks—are concentrated in one place. By using multiple platforms, you can compare performance, avoid downtime disruptions, and access markets or instruments that may not be supported on Exness.

Additionally, different brokers provide different educational resources, account types, and customer support experiences. Trying new platforms exposes traders to various ecosystems, helping them learn new approaches and adapt to market environments more effectively.

Experimenting with other platforms is a strategic move, not a replacement. Exness can remain a preferred broker, but keeping an open mind allows traders to discover new opportunities, identify better tools, and build resilience in their trading workflow. By expanding beyond one platform, traders develop broader experience and make more informed decisions throughout their forex journey.

What are the 5 Best Exness Alternatives for Forex Traders?

1. Pocket Option

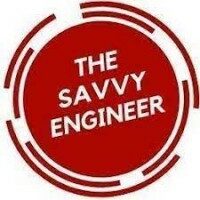

In the forex trading world, Exness has built a strong reputation for its reliability and advanced tools, but it may not always fit the needs of every trader—especially those who want a simpler, more flexible trading experience. This is where Pocket Option emerges as a compelling forex alternative. Designed with accessibility at its core, Pocket Option combines ease of use, fast execution, and a visually friendly interface that appeals to both beginners and active day traders.

While Exness focuses heavily on professional-grade forex features, Pocket Option offers a more streamlined approach, allowing traders to access currency pairs quickly and make decisions without navigating complex menus. Its charting tools, customizable layouts, and wide range of indicators give traders the analytical support they need, without overwhelming them with advanced settings. For new traders, this balance of simplicity and functionality can make a significant difference in learning and confidence.

Another advantage is the platform’s convenience. Pocket Option supports multiple payment methods, instant deposits, and a demo account that mirrors real-market behavior, making it easy to practice and transition into live forex trading. With its user-friendly design and versatile tools, Pocket Option stands out as a practical and efficient alternative for traders who find Exness too technical or restrictive.

2. IQ Option

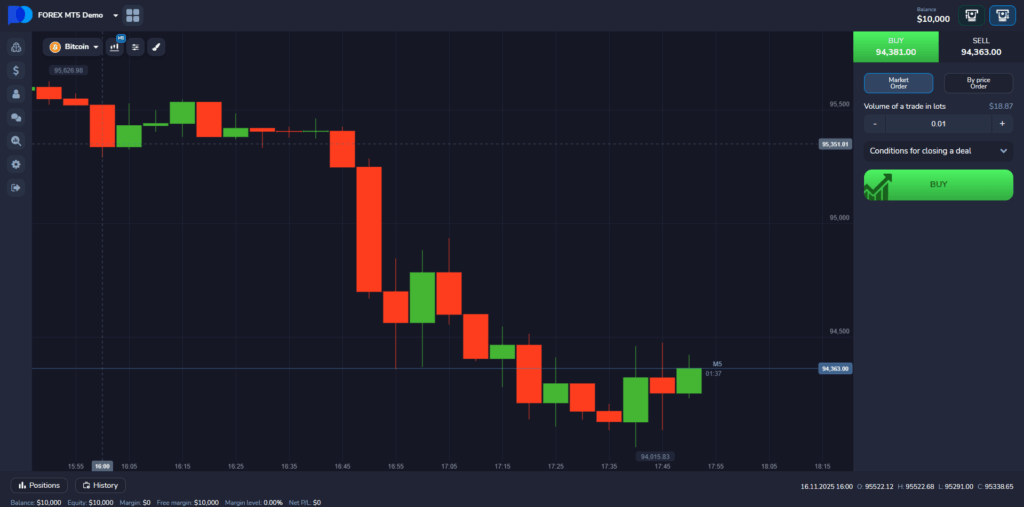

In the competitive world of online forex trading, Exness has long been recognized for its stability, tight spreads, and professional-level tools. However, not every trader thrives in a highly technical environment. Many traders—especially beginners and intermediate users—often seek a platform that feels more intuitive, visually engaging, and easier to navigate. This is where IQ Option stands out as one of the most attractive forex alternatives to Exness.

IQ Option is designed with a strong focus on user experience. Its interface is clean, responsive, and packed with interactive charting features that make forex analysis feel approachable even for newcomers. Instead of overwhelming traders with too many advanced settings, IQ Option delivers a balanced environment where essential tools are presented clearly and effectively. This makes it appealing to users who want a smoother trading experience without sacrificing analytical capability.

Another key advantage is the platform’s wide accessibility. IQ Option supports flexible deposit options, offers low minimum investment requirements, and includes a realistic demo account for practicing forex strategies without financial risk. For traders who felt that Exness required too steep a learning curve, this practical hands-on environment can be a major benefit.

Additionally, IQ Option integrates technical indicators, drawing tools, and time-based chart customization in an intuitive way, allowing traders to quickly test strategies and adapt to market movements. The platform’s focus on simplicity, blended with professional-grade tools, makes it a strong contender for those seeking an alternative to Exness.

For traders who value an easy-to-use interface, strong visual tools, and a more beginner-friendly learning experience, IQ Option can be one of the best alternatives to Exness for forex trading.

3. XTB

In today’s fast-paced forex market, traders often seek platforms that deliver both reliability and flexibility. While Exness is known for its competitive spreads and strong execution speeds, it may feel too technical or specialized for some traders. Those looking for a more well-rounded, educational, and transparent trading environment often find XTB to be one of the best alternatives.

XTB distinguishes itself with a powerful yet user-friendly ecosystem built around its proprietary platform, xStation 5. This platform offers a smooth, intuitive trading experience with advanced charting tools, real-time performance analytics, and a layout that adapts naturally to traders at all levels. Unlike platforms that overwhelm users with dense settings, xStation 5 strikes a balance between functionality and simplicity, giving traders access to professional tools without steep learning barriers.

Another reason XTB appeals to traders shifting from Exness is its strong emphasis on education and trader development. The platform provides in-depth courses, live webinars, market analyses, and trading tutorials that empower users to refine their forex strategies. This educational support creates a more structured learning environment compared to platforms that focus primarily on execution and technical metrics.

Beyond that, XTB is well-known for its strict regulation and transparent pricing model. Traders who value clarity in fees, trustworthy oversight, and strong client protection find these qualities particularly reassuring. The platform also offers responsive customer support, ensuring that new users receive guidance as they transition from other brokers.

For traders seeking a regulated, easy-to-use, educational, and analytically driven forex environment, XTB stands out as one of the strongest alternatives to Exness, offering a more supportive and holistic trading experience.

4. Plus500

In the forex trading landscape, Exness is often recognized for its fast execution and competitive conditions, but some traders may prefer a platform with a more streamlined, beginner-friendly structure. Plus500 stands out as an excellent alternative for those who want a simple, transparent, and regulation-focused trading environment without the complexity found on more advanced platforms.

Plus500 is built around ease of use. Its platform features a clean interface that minimizes distractions, making it ideal for traders who prefer straightforward charting tools and clear navigation. Unlike environments that bombard users with technical settings, Plus500 keeps its controls intuitive while still offering essential indicators, drawing tools, and customizable chart views. This design helps new traders adapt quickly and gives experienced traders a fast and efficient place to execute forex trades.

Another advantage is Plus500’s strong regulatory background. The platform operates under multiple reputable financial authorities, offering a high level of security and transparency. This appeals to traders who want a consistent and trustworthy trading experience with clearly defined costs and no hidden complications.

Plus500 also provides risk-management tools such as guaranteed stop orders and negative balance protection, features that many traders value when moving away from platforms that focus more heavily on execution speed rather than safety tools.

Plus500 offers a clean, reliable, and accessible environment that complements the more technical nature of Exness. For traders seeking simplicity, transparency, and strong regulation in their forex trading, Plus500 becomes a highly appealing alternative.

5. Etoro

In the forex trading world, Exness is widely respected for its fast execution and competitive spreads, but not all traders thrive in a purely technical and data-driven environment. Many traders—especially beginners or those who enjoy community-driven learning—are drawn to platforms that offer more interaction, simplicity, and guidance. This is where eToro becomes one of the strongest alternatives to Exness.

eToro stands out with its unique social trading ecosystem, a feature that allows users to observe, learn from, and even copy the strategies of experienced forex traders. This community-focused approach makes forex trading more approachable, particularly for newcomers who might find Exness too advanced or less interactive. Instead of trading alone, users can engage with others, discuss market ideas, and follow real trading activity in a transparent environment.

Another advantage is eToro’s clean, modern interface. Its platform is designed for clarity, offering simple navigation, integrated charting tools, investor performance stats, and organized trade information. This structure helps traders stay focused without the steep learning curve associated with more specialized forex platforms.

eToro also emphasizes investor protection and regulatory compliance, operating under reputable global authorities. Features like risk scoring, portfolio tracking, and trade-management tools give users more control and transparency in their trading decisions.

For traders who value social learning, visual simplicity, and a more community-driven approach to forex, eToro becomes an appealing and effective alternative to the more technical and execution-focused environment of Exness.